But e-commerce accounting is more than just tracking accounts payable and recording sales and expenses. It’s also understanding how your business operates, what drives your profitability, and how to plan for the future. Once you’ve begun a QuickBooks subscription and imported relevant merchant details, it’s time to set up your Chart of Accounts. This is where you can categorize your liabilities of an auditor ppt sales and expenses (ideally on a weekly or monthly basis depending on sales volume) to manage your cash flow and assess financial performance.

Although e-commerce accounting software will typically let you choose either method, many default to accrual accounting. Tax management for e-commerce stores can be difficult, but it’s much easier if you have accounting software to manage the process. However, you must still track and pay state and local taxes, as well as make tax-related filings, such as sending Form 1099 to contractors. E-commerce accounting is the process of recording, tracking, and analyzing financial transactions that occur within an online business. This comprehensive guide will provide you with the information you need to successfully integrate QuickBooks with your e-commerce platform.

- It’s not enough to draw visitors to your site; you’ll need to provide an engaging and easy-to-use website that reflects your brand and products.

- This is a list of all the accounts you will use to track your income and expenses.

- It provides inventory management, multichannel selling, and accounting synchronizations to small-business customers.

- We never stop working to find new, innovative ways to make that possible.

- You can create your own chart of accounts or use a template provided by QuickBooks.

- For accounting purposes, this debt only matters once the money leaves your account.

Seamlessly connect your online sales

Tax management can be complicated, and mistakes in filing or interpreting the tax code can have serious consequences for business owners. That’s why tax management (including both tax planning and preparation) is a core service of many accounting firms. There’s the day your product is market-ready, the day you open your online store to the world, and the day you make your first sale—a major step that calls for celebration. As an ecommerce entrepreneur, few things are more exciting than watching the money start to roll into your bank account.

Selecting Inventory Management Software for Canadian Retailers

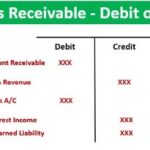

E-commerce bookkeeping handles day-to-day financial transactions. Examples of bookkeeping tasks include managing invoices, inventory, payroll, accounts receivable, and accounts payable. When it comes to verifying the complete accuracy applications open for ontario small business support grant of your QuickBooks accounts, the best practice to follow is monthly bank reconciliation. If you don’t do this, you won’t be able to identify and fix any errors in a timely fashion.

With online retail bigger than ever, there are a few important things to know to help you achieve success as a small business owner. Looking at your business from the customer perspective and anticipating their needs can go a long way. Encourage customers to buy by making them feel confident about purchasing your goods. Consider providing incentives to purchase now rather than later.

Cash flow planning

If you’re wondering what we think of QuickBooks as accounting what are the purpose of a post closing trial balance software for your business, check out our review. Accepting credit cards in today’s small business marketplace can translate into closing every sale and delivering good customer experience. Checkout should be a breeze once you’re set up to accept credit cards on your website. Customers should be able to complete a transaction in as few clicks as possible. It’s not enough to draw visitors to your site; you’ll need to provide an engaging and easy-to-use website that reflects your brand and products.

Ready to hire an experienced eCommerce accounting firm?

You’ll want to continually analyze your funnel based on audience responses and research. The more you refine your funnel, the greater the benefit will be to your business, your brand, and your bottom line. Your QuickBooks account has a lot of sensitive company and financial details. It is in your best interest to keep a close eye on who has access and what they have access to.

We will cover topics such as setting up QuickBooks, connecting it to your e-commerce platform, and troubleshooting any issues that may arise. By the end of this guide, you will have a better understanding of how to integrate QuickBooks with your e-commerce platform and be able to take advantage of the many benefits it offers. QuickBooks Commerce is a good, sturdy inventory management platform.

Topical articles and news from top pros and Intuit product experts. Learn how to practice competitive pricing by offering more attractive payment terms than your competition. Manage your eBay orders and payouts to streamline operations and focus on growth. Speed up backend operations on Shopify to optimize sales velocity when you need it most. Here are 10 of the most common e-commerce pitfalls and simple ways to avoid them.