For lower return projects, management will only accept the project if the risk is low which means payback period must be short. Finally, we can determine the total payback period by adding the negative cash flow years and fractional period. Uneven cash flows can be defined as a series of unequal payments paid over a given period. The cash flow changes from time to time, so there is no fixed repayment amount. For example, a series of payments of $2000, $5000, $3000, and $2500 over 4 different years can be defined as uneven cash flows.

Payback Period Calculator

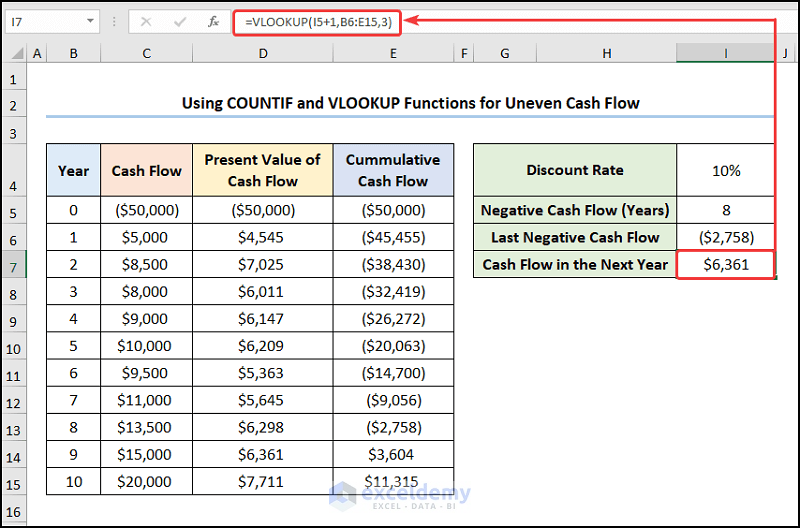

In Excel, create a cell for the discounted rate and columns for the year, cash flows, the present value of the cash flows, and the cumulative cash flow balance. Input the known values (year, cash flows, and discount rate) in their respective cells. Use Excel’s present value formula to calculate the present value of cash flows.

Payback Period Calculation Example

Consider a company that is deciding on whether to buy a new machine. Management will need to know how long it will take to get their money back from the cash flow generated by that asset. The calculation is simple, and payback periods are expressed in years.

Calculating Payback Period in Excel with Uneven Cash Flows

For example, if it takes five years to recover the cost of an investment, the payback period is five years. Conversely, the longer the payback, the less desirable it becomes. For example, if solar panels cost $5,000 to install and the savings are $100 each month, it would take 4.2 years to reach the payback period. The payback period is a method commonly used by investors, financial professionals, and corporations to calculate investment returns. Between mutually exclusive projects having similar return, the decision should be to invest in the project having the shortest payback period. The payback period is a major consideration for sectors that are prone to projects fast becoming outdated.

Step 3: Obtaining Last Negative Cash Flow

Her expertise is in personal finance and investing, and real estate. Our table lists each of the years in the rows and then has three columns.

- Depreciation is a non-cash expense and therefore has been ignored while calculating the payback period of the project.

- Payback period means the period of time that a project requires to recover the money invested in it.

- The value indicates the exact time it will take to recover initial costs, and helps to evaluate the risks of the project.

You might one to know how many years you need for this investment to pay back. This calculation can be further complicated by the irregular cash flows that you receive. The shortest payback period is generally considered to be the most acceptable.

In the financial world, understanding how to calculate the payback period is crucial for evaluating an investment or a project. The payback period is the time taken to recover the initial investment cost through the cash inflows generated by the project. When a project has uneven cash flows, calculating the payback period can be a little more challenging, but it’s still possible. In this article, we will discuss how to calculate the payback period with uneven cash flows. The discounted payback period is the number of years it takes to pay back the initial investment after discounting cash flows.

We will take some uneven cash flows and create cumulative cash flows. Then, using the IF function, we will calculate our desired payback period. Once you have entered all the numbers as stated above, click on “Calculate” button. This means cash disbursement journal definition that your investment will take approximately 3.875 years to get your initial investment of $ 2,500 back. Additionally, if you click on the fixed CF tab, you need to only define one cash flow assuming that this cash flow will be fixed.

The quicker a company can recoup its initial investment, the less exposure the company has to a potential loss on the endeavor. Average cash flows represent the money going into and out of the investment. Inflows are any items that go into the investment, such as deposits, dividends, or earnings. Cash outflows include any fees or charges that are subtracted from the balance. Due to its ease of use, payback period is a common method used to express return on investments, though it is important to note it does not account for the time value of money.